Green shipping strategy for the GLSL system

GovernmentGreen Marine overview advances Governors and Premiers’ Green Shipping Action Plan

A Green Marine report identifying opportunities to improve the Great Lakes St. Lawrence maritime transportation system (MTS) has served as a springboard for several other initiatives by the Conference of Great Lakes St. Lawrence Governors & Premiers (GSGP), as well as a closer look at some of the environmental certification program’s emphasis.

“The Green Marine report presented to our region’s Governors and Premiers last fall has helped to inform their five-year action plan and green shipping strategy for the region’s maritime system,” says John Schmidt, the GSGP’s Maritime Initiative’s new Project Manager. “The report kicked off our priorities and has been instrumental to advancing our maritime goals at the same time as the GSGP added a new full-time maritime program manager to spearhead this important work.”

GSGP had commissioned the report as part of its new regional strategy to double maritime trade while reducing the transportation mode’s environmental footprint. Green Marine prepared the report in collaboration with the Research and Traffic Group based on the best practices of its participating membership, as well as a survey of European initiatives.

With the exception of climate resilience and adaptation measures, all the recommendations already form part of Green Marine’s progressively challenging environmental performance indicators that are used to benchmark and subsequently gauge improvement.

“Green Marine participants in the Great Lakes St. Lawrence region – as elsewhere – are committed to improving air quality, protecting biodiversity, maintaining water quality, and minimizing community impacts,” says Véronique Trudeau, Green Marine’s Program Manager in charge of the study. “However, the study also indicated the need to do more in terms of both decarbonization and waste management.”

We took Green Marine’s advice that you can’t manage what you don’t measure.

Regional emissions inventory

GSGP condensed the Green Marine’s findings into a Green Shipping Action Plan that prioritizes several of Green Marine’s recommendations as next steps. At the top of this list was investigating the establishment of an emissions inventory so that reduction targets for the regional maritime system could be set and progress measured.

Anthony Aird, Unsplash

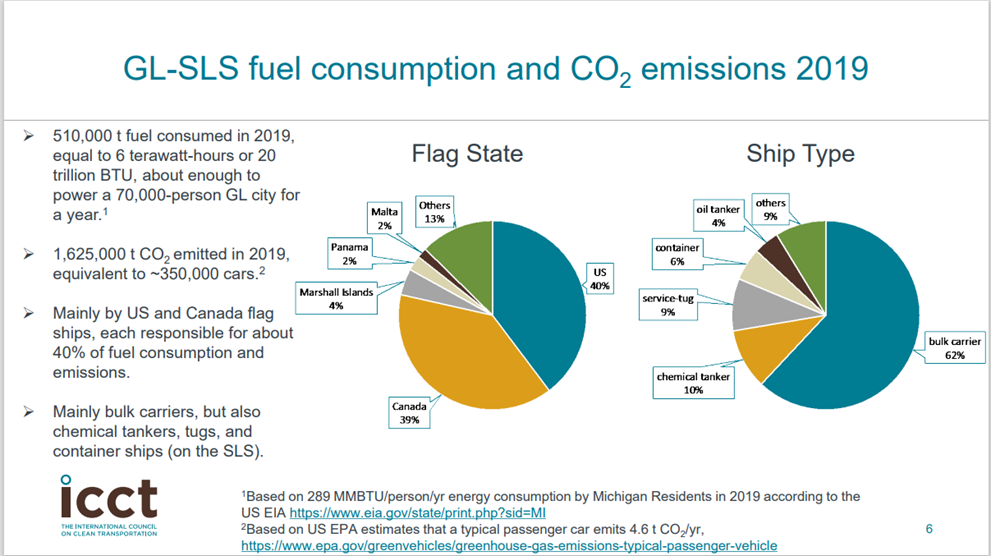

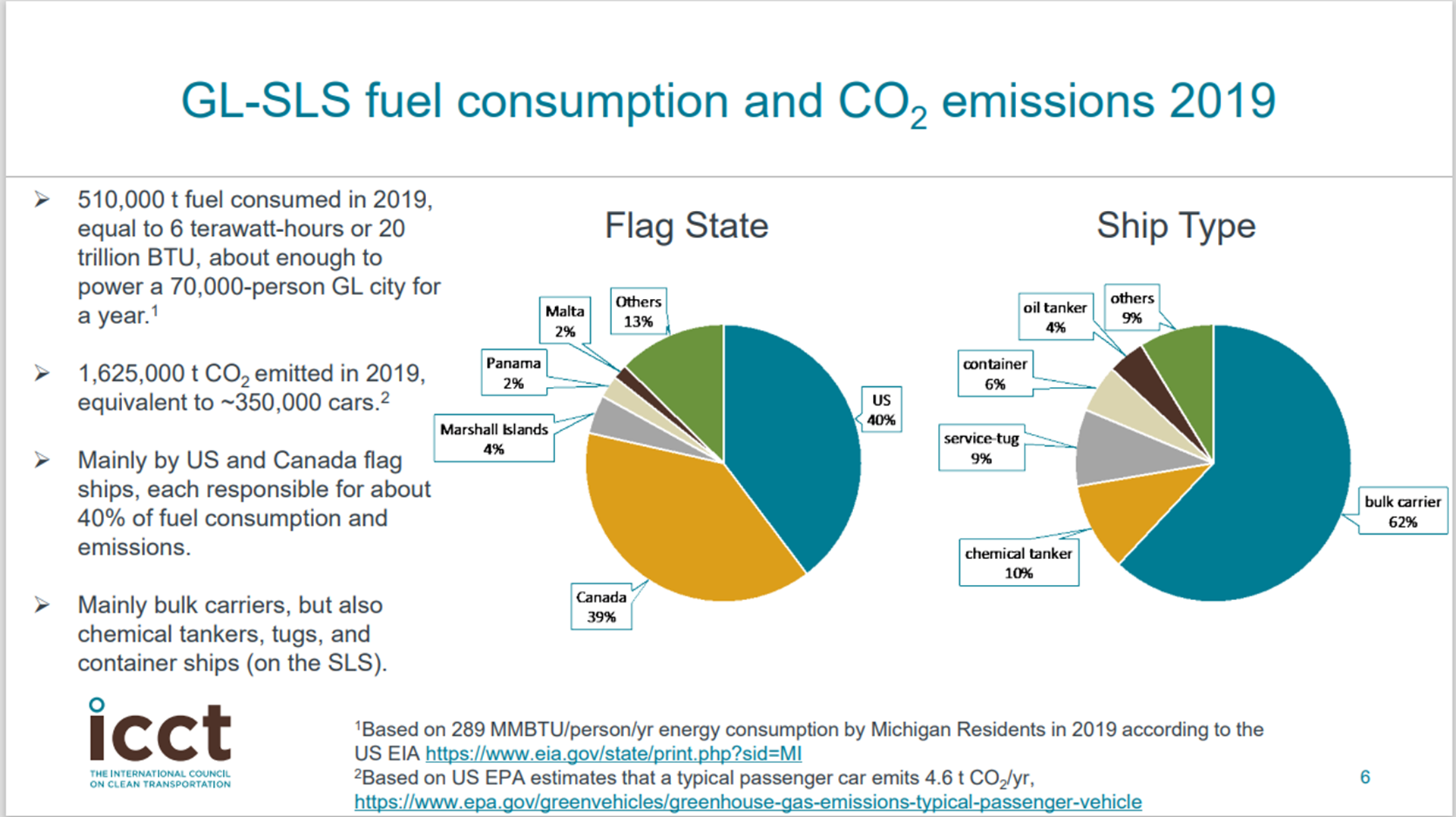

“We took Green Marine’s advice that you can’t manage what you don’t measure and worked with the International Council on Clean Transportation to create the very first emissions inventory of vessels operating in the St. Lawrence and Great Lakes system,” Schmidt says. “ICCT has been able to aggregate individual vessel data to clearly indicate the amounts of emissions and their concentrations because of the type of vessel, route frequency or the narrowness of the area.”

The initial Energy Use and Emissions from Great Lakes-St. Lawrence Seaway Vessels in 2019 inventory was released in March with the 2020 and 2021 data expected later this year. “We look forward to working with ICCT to provide an annual inventory going forward,” Schmidt adds.

Soo Lock reanalysis

The Green Marine report’s attention to GHG emissions has also prompted the GSGP to take a closer look at the plans for the new Soo Lock. “We’ve contracted with the Axia Institute, whose researchers at Michigan State University specialize in finding sustainable solutions for value chains, to see how we can maximize efficiency, safety and environmental performance with various technologies,” Schmidt says. “One possible example is vessel traffic management so that vessels show up when it’s their turn to go through the lock with no time or fuel lost in waiting or hurrying unnecessarily to get there.”

While hands-free mooring (HFM) has primarily been installed at St. Lawrence Seaway locks for safety reasons, Schmidt notes that it shaves time off each vessel’s transit through each lock, which likely results in significant fuel savings and emissions reduction.

How best to use the existing Soo lock and the planned new one in tandem when it comes to traffic movement and system maintenance is also being analyzed.

Biofuel exploration

Further research was initiated into biofuel’s feasibility after the Green Marine study noted its potential in promptly and significantly reducing GHG, especially if the biofuel is second generation (derived from agricultural residues, used cooking oil, or municipal waste).

“When the Green Marine report broke down some of the potential emissions reductions, it really prompted us to think anew about biofuel’s possibilities as a stepping-stone to a greener future,” Schmidt says. The GSGP subsequently commissioned a report by students at the University of Michigan to investigate the supply- and demand-side drivers of biofuels adoption.

The students consulted with staff from CSL, Sterling Fuels, the Chamber of Marine Commerce and other experts in the course of their research.

The Maritime Biodiesel Use Case released in mid-January concluded that Canadian and U.S. subsidies and credits could help make biofuels a more attractive source of cleaner alternative fuel. The financial support is required both to scale up supply, and to offset the price differential. The report also noted that the 12-14% fuel density variation would not be a huge factor within the Great Lakes where vessels could refuel during more frequent port stops.

GSGP has since contracted Innovation Maritime, a Green Marine partner, to carry out a more detailed analysis. “The Innovation Maritime researchers are looking at the full carbon lifecycle of the different generations of biofuel, their comparative energy densities, as well as their likely supply given current and potential government policies as all types of transportation must become less carbon-emitting,” Schmidt explains. “We’re expecting to have some findings from the first phase of this research this summer and then expect to begin Phase Two of this analysis.”

Electrification at ports

The Green Marine report also related the possible near-term cost advantages and long-term viability of establishing more direct plug-in power for vessels at ports. Electrification is particularly worth investigating at ports where renewable hydroelectricity is readily attainable.

With the lowest rate paid by industrial customers using a large, fixed draw of electricity, shore power becomes more economical with a vessel’s regular frequent calls, according to the Research and Traffic Group’s findings.

As a result, the study recommended assessing what the shore power cost would be based on a set number of port calls by a ship owner per month, and to begin this assessment at the busiest self-unloading ports first because of the regular visits and hours of operation.

The findings prompted GSGP to further investigate electrification. An internally authored study noted that the Great Lakes St. Lawrence maritime industry faces some unique challenges when it comes to electrification, starting with the need for technology and equipment that can offer a certain level of reliability in the harsher climate shouldering winter.

Ship owners renewing or refitting their fleet for electrification might furthermore be put at economic disadvantage compared to those remaining with traditional fossil-fueled vessels unless some kind of transitional subsidy is provided. Another challenge requiring additional research and development relates to the large size and weight of current battery packs that could displace cargo and put electric-running cargo vessels at a competitive disadvantage.

Norway’s stewardship

The current feasibility of electrifying a laker would depend on it traveling short consistent distances to ports with readily accessible recharging facilities. However, these can make a difference. For example, the Yara Birkeland bulk carrier in Norway can only transport goods to nearby cities since its electrification in 2021 because of its battery capacity, but that could still eliminate 40,000 annual truck transports.

This content is not available because some cookies are blocked.

By clicking on this link, you agree that Youtube may collect data about you for targeting purposes. The video content will be displayed.

Journey of the Yara Birkeland from Horten to Oslo

At the same time, an estimated 80% of Norway’s ferries will be electrified partially or fully this year in good part as a result of several government actions that include a carbon tax that motivates emission reduction, lowered electricity rates, and a state-owned enterprise distributing funds totaling some $638 million to accelerate transitions. E-Ferry, an organization focused on designing and building electric ferries, has also noted that while the new vessels are approximately 40% more expensive, they have about one-quarter of a diesel ferry’s operating costs and can be profitable within four to five years.

“However, it can be a difficult value proposition for ship owners to make the big investments necessary to make their vessels plug-in ready unless they’re assured of charging stations and a reliable, cost-effective electricity supply,” Schmidt says. “Therefore, we’ve done a survey that will help us to create a map indicating the type of shore power already available at ports – for cruise ships, ferries, cargo vessels or onshore equipment – with the goal of better understanding these facilities as a possible starting point for a truly green marine corridor.”

Prioritizing investments

The map and GHG data will help inform thinking about where new shore power installations could make the biggest impact in terms of reducing emissions. “The survey also seeks to find out the challenges that ports face when it comes to installing shore power,” Schmidt adds.

We expect that cost, operational issues and questions about future demand are the major hindrances for ports to install more shore power.

“We plan to conduct more research on possible funding and financing mechanisms for ports that would like to install shore power.”

The Green Marine report integrated an overview of some of the main or most notable environmental and sustainability efforts of the region’s maritime industry over the past five years, posing further questions to some participants when it required additional information.

“It was a really good exercise because while we have the annual performance results of our participants, this made us look more closely at what they are all doing in terms of best practices and special initiatives,” Trudeau says. “Collating all of the success stories featured in our newsletter over the past five years gave us a more complete picture.”

Required waste reduction

As with decarbonization, the review of success stories and interviews with participants also underscored the industry’s need to apply greater efforts to waste management. “It’s clearly not the most appealing subject, but it’s a huge global problem and an area in which our industry can likely do a lot more,” Trudeau says.

One of our recommendations was to reinforce the importance of the 3RV – reduce, reuse, recycle and valorize principles.

Further reduction of waste at source and the diversion of waste from incinerators and landfill sites were particularly noted in the report as essential to reduce the industry’s impact. “One of our recommendations was to reinforce the importance of the 3RV – reduce, reuse, recycle and valorize principles – within the maritime culture, particularly when it comes to finding ways to reduce waste at source,” Trudeau says.

Other recommendations included the greater implementation of annual waste inventories that characterize and measure the different types of waste, and the subsequent development and implementation of a waste management plan. A greater focus on sustainable purchasing and circular economy projects was also suggested.

“Since the report was done a year ago, we’re already seeing an improvement by our participating membership in terms of waste management based on 2021 reporting results and we’ll likely take steps to further encourage these efforts,” Trudeau says.

The report Opportunities to improve environmental performance in the Great Lakes St. Lawrence Transportation system is available on the Green Marine website.